stop on quote versus stop limit on quote

A stop-limit order combines two types of orders a stop order with a stop price and a limit order with a limit price that may or may not be the same as the stop price. A stop-limit-on-quote order is an order that an investor places with their broker which combines both a stop-loss order and a limit order.

Positive Minntest Quotes No Limits Quotes Stop Saying Can T Quotes Change Your Mindset Quotes Limit Quotes Mindset Quotes Motivational Quotes For Men

The stop-limit order can help address this scenario.

. The stop price and the limit price for a stop-limit order do not have to be the same price. This frees the investor from monitoring prices and allows the investor to lock in profits. Account holders will set two prices with a stop limit order.

Stop loss and stop limit orders are commonly used to potentially protect against a negative movement in your position. So you can set both a limit order and a stop order on Merrill Edge. But this time youre also going to place a limit at the minimum price youre willing to sell the shares lets say 95.

Such an order would become an active limit order if market prices reach 300 however the order can only be executed at a price of 250 or better. In our first example you were sold out at 90 because once. If the currency or security for trading reaches the stop price the stop order becomes a market order.

Limit orders are executed automatically as soon as there is an opportunity to trade at the limit price or better. Etrade changed the stop loss function some time ago. Stop Quote limit order is a combination of both a stop quote and a limit order.

The decision regarding which type of order to. A stop-loss order assures execution while a stop-limit order ensures a fill at the desired price. A buy-stop order is a type of stop-loss order that protects short positions.

Limit and Stop-Loss Orders In conclusion limit and stop-loss orders are two of the most commonly used and popular order types when trading stocks because they offer the investor more control over how they react to the markets price discovery process than standard market orders where the investor is agreeing to pay whatever the current market price is. It is a pending order to at the stop price or lower. The stop price and the limit price for a stop-limit order do not have to be the same price.

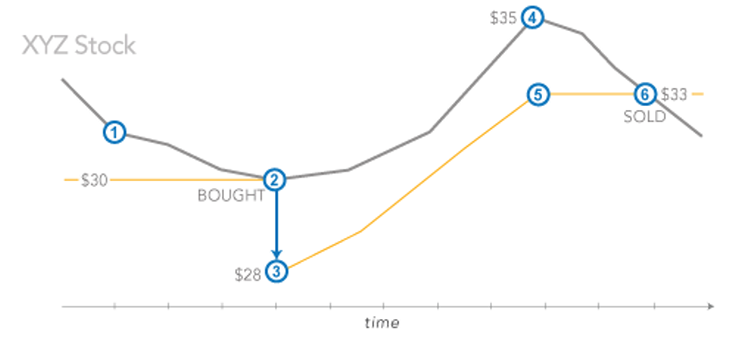

By selling at the stop. Lets consider a trader who bought FB for 155 and it is now trading at 185. Lets use this same premise with you holding shares of XYZ at 100 and setting a stop order at 98.

When the stop price is triggered the limit order is sent to the exchange. A stop-limit-on-quote order is an order that an investor places with their broker which combines both a stop-loss order and a limit order. It is set above the current market price and is triggered if the.

Your limit price must be lower than or equal to your stop price when selling and must also be within 9 per cent of your stop price. Sell order for stop quote limit order is placed when the price is below the stocks current market price and it will trigger when the price is lower than the decided price. In contrast a sell stop order executes at a stop price below the current market price.

Im a dreamer and i dream in full vivid color hd. Your limit price must be lower than or equal to your stop price when selling and must also be within 9 per cent of your stop price. To protect a portion of their gains 15 the trader places a sell order to stop at 170.

For example a sell stop limit order with a stop price of 300 may have a limit price of 250. Stop on quote versus stop limit on quote. You use a sell stop to set a price lower than the market price to minimize loss.

Trailing stop orders may have increased risks due to their reliance on trigger pricing which may be compounded in. Stop Loss Limit. A buy stop order executes at a stop price that is above the current market price.

A stop order on the other hand is used to limit losses. In other words the major difference between a stop limit order and a stop order is that the latter does not place a market order when your stop level is triggered. The stop price and the limit price.

For example a sell stop limit order with a stop price of 300 may have a limit price of 250. With a stop limit order traders are guaranteed that if they receive an execution it will. A limit order will then be working at or better than the limit price you entered.

Learn how to use these orders and the effect this strategy may have on your investing or trading strategy. Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better. The trade will only execute at the set price or better.

Your limit order is. Stop limit orders are slightly more complicated. Once the stop level is hit a limit order with the instruction to buy at the limit price is executed.

Stop Loss on Quote is sell the stock to the BID price when the stock price reaches the set price. Such an order would become an active limit order if market prices reach 300 however the order can only be executed at a price of 250 or better. When the stock reaches your stop price your brokerage will place a limit order.

If the price drops at the stop price there is an assumption that the price will continue to fall. Limit is an important distinction that can significantly change the outcome of your order. Is trading at 30 and the investor wants to buy stock after it starts to show serious upward momentum around 35.

Whereas once a stop order triggers at the specified price it will be filled at the prevailing price in the marketwhich means that it could be executed at a price significantly different than the stop price. Bad thing about SLOQ is if.

Investor Bulletin Stop Stop Limit And Trailing Stop Orders Investor Gov

/dotdash_Final_How_the_Trailing_Stop_Stop_Loss_Combo_Can_Lead_to_Winning_Trades_Sep_2020-01-4c3b54bb0ca947608471ea2248542111.jpg)

Trailing Stop Stop Loss Combo Leads To Winning Trades

What Is A Conditional Order Fidelity

How To Use A Stop Limit On Quote Order The Motley Fool

I Won T Stop I Won T Quit Motivation Fitness Motivation Photo Fitness Motivation Pictures

If You Are A Giver Please Know Your Limits Because The Takers Don T Have Any Witty Quotes Feelings Quotes Life Quotes

Potentially Protect A Stock Position Against A Market Drop Learn More

Limit Order Vs Stop Order Difference And Comparison Diffen

The Only Person That Can Stop You From Reaching Your Goals Is You Don T Limit Yourself With Negative Th Quotes To Live By Positive Mental Attitude True Quotes

Comments

Post a Comment